TheView24

Truth • Transparency • Trust

Loading...

How Much Emergency Fund You Really Need (With Examples)

- Home

Category

How Much Emergency Fund You Really Need (With Examples)

By Mazhar

Staff Writer

An emergency fund is money set aside to cover unexpected expenses such as medical emergencies, job loss, urgent repairs, or sudden income disruption.

This article explains how much emergency fund you really need, how to calculate it based on your situation, and how to build it step by step.

An emergency fund is a financial safety net designed to protect you from debt during unexpected life events.

It is not meant for vacations, shopping, or planned expenses, but only for true emergencies.

Without an emergency fund, people often rely on credit cards or loans, which leads to long-term debt.

An emergency fund provides peace of mind and financial stability during uncertain times.

The ideal emergency fund amount depends on your monthly expenses, income stability, and personal responsibilities.

Most financial experts recommend saving between 3 to 6 months of essential expenses.

Step 1: Calculate your monthly essential expenses, including rent, food, utilities, transportation, and basic bills.

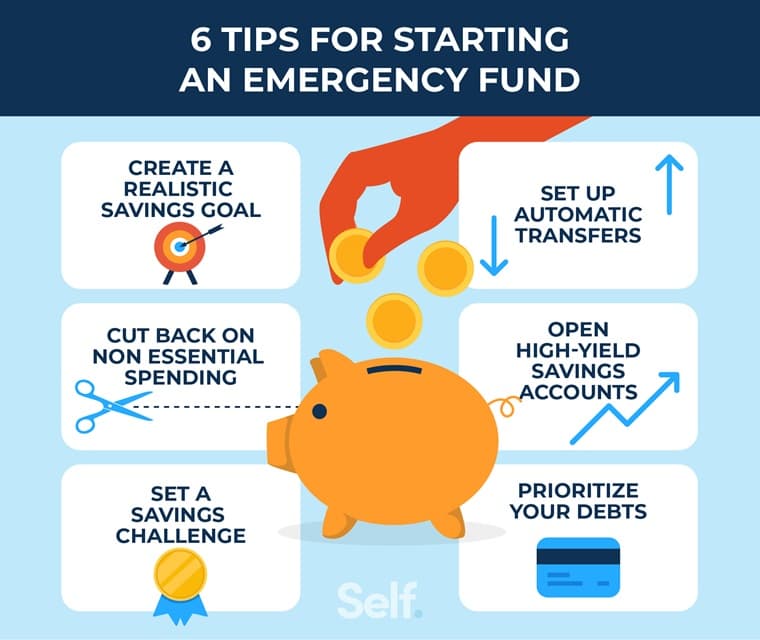

Step 2: Multiply this number by 3 if you have a stable income, or by 6 if your income is irregular.

For example, if your monthly expenses are $1,000, your emergency fund should be between $3,000 and $6,000.

Salaried employees with stable jobs can start with 3 months of expenses.

Freelancers, business owners, or commission-based workers should aim for at least 6 months of expenses.

People with dependents should consider saving a higher amount for added security.

Emergency funds should be kept in a safe and easily accessible place.

High-interest savings accounts or liquid accounts are ideal options.

Avoid investing emergency funds in stocks, crypto, or long-term assets.

Start small by saving a fixed amount every month, even if it is a small percentage of your income.

Automate savings so the money is set aside before you spend it.

Increase contributions whenever your income increases or expenses decrease.

Using emergency funds for non-emergencies, not replenishing after use, and keeping money in risky investments are common mistakes.

Final Thoughts An emergency fund is one of the most important foundations of personal finance.

Even a small emergency fund is better than none, and building it gradually can protect you from financial stress and debt.