TheView24

Truth • Transparency • Trust

Loading...

Tech

Best Budgeting Apps Compared: Which One Helps You Save More?

October 23, 20255 min read2.1k views

- Home

Category

Best Budgeting Apps Compared: Which One Helps You Save More?

By Mazhar

Staff Writer

B

Budgeting apps have made personal finance easier and more accessible than ever.

Instead of tracking expenses manually, these apps help users manage income, control spending, and build savings efficiently.

This article compares the best budgeting apps and explains how they can help you save more money.

Why Use a Budgeting App?

Many people struggle with saving because they don’t track where their money goes.

Budgeting apps provide a clear overview of spending habits and financial health.

Benefits of budgeting apps include:

• Easy expense tracking

• Better money awareness

• Improved saving habits

• Reduced financial stress

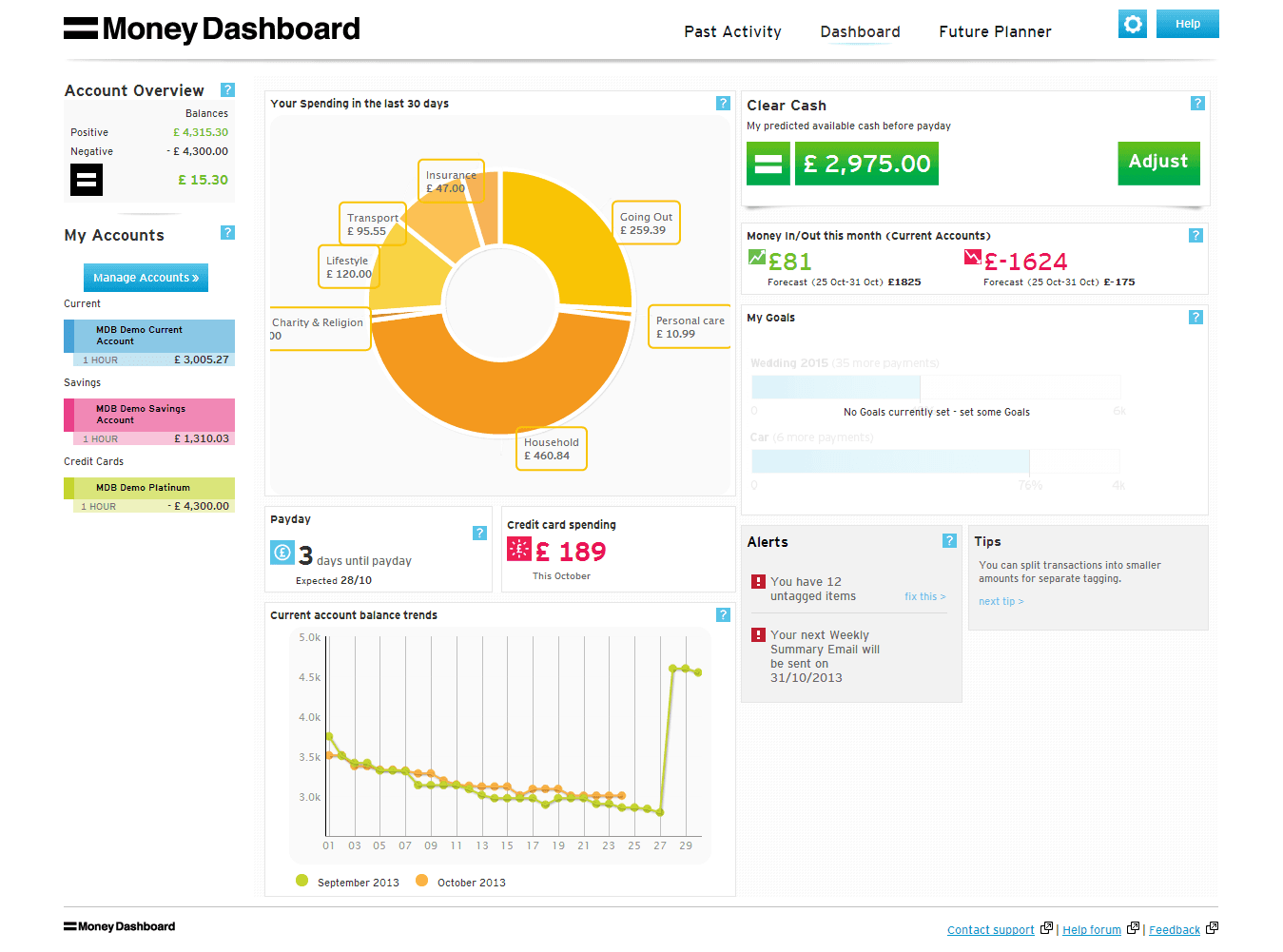

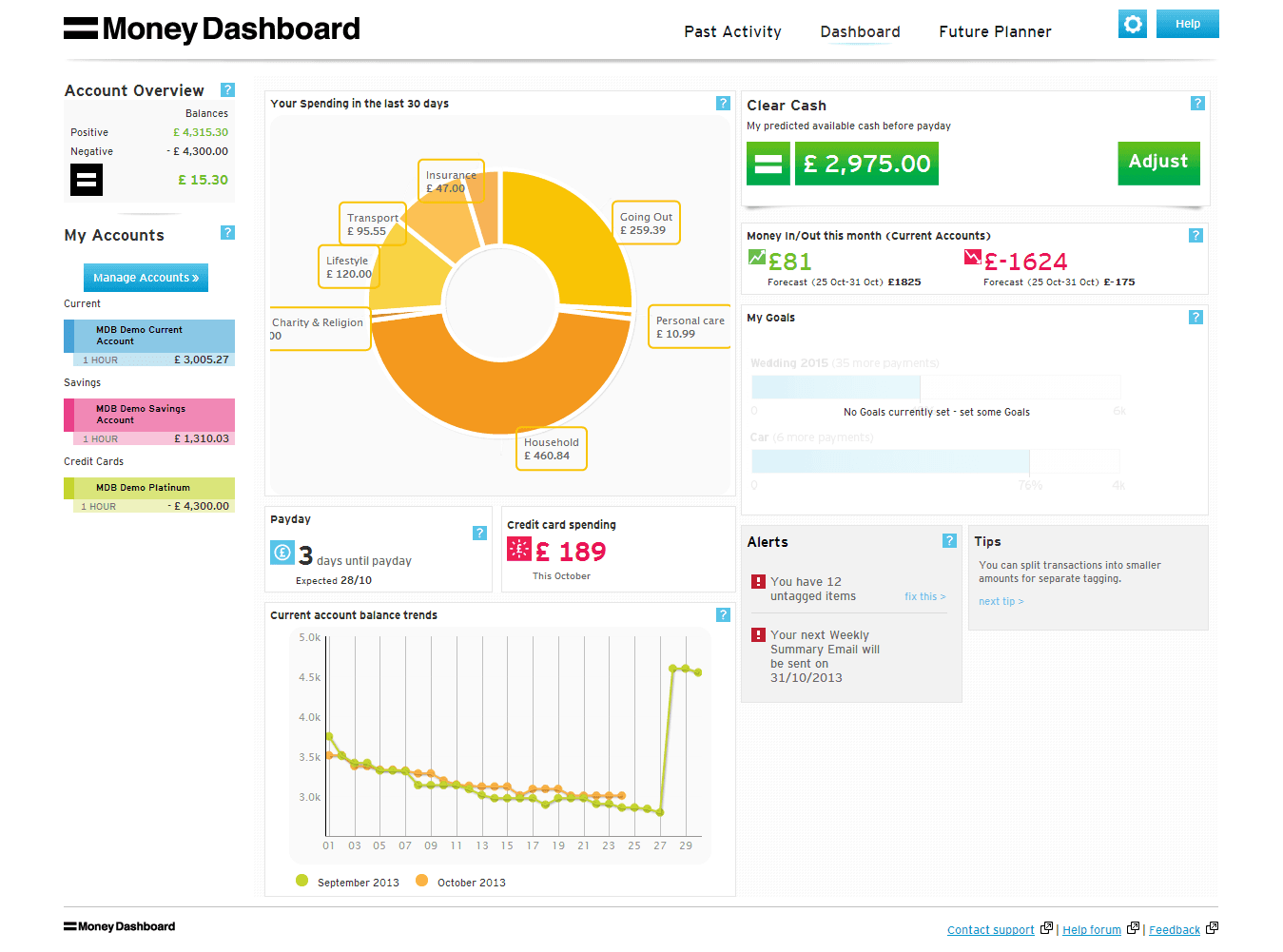

Key Features to Look for in a Budgeting App

Not all budgeting apps are the same.

Choosing the right one depends on your financial goals and lifestyle.

Important features include:

• Expense categorization

• Budget alerts

• Savings tracking

• Bank synchronization

• User-friendly interface

1. Mint – Best for Beginners

Mint is one of the most popular free budgeting apps.

It automatically tracks expenses and categorizes transactions.

Best features:

• Automatic expense tracking

• Budget alerts

• Credit score monitoring

Ideal for:

• Beginners

• Simple budgeting needs

2. YNAB (You Need A Budget) – Best for Serious Budgeting

YNAB focuses on proactive budgeting.

It encourages users to assign every dollar a job.

Best features:

• Goal-based budgeting

• Debt management tools

• Educational resources

Ideal for:

• People focused on saving

• Debt reduction goals

3. PocketGuard – Best for Expense Control

PocketGuard shows how much money you can safely spend.

It prevents overspending by calculating disposable income.

Best features:

• Spending limits

• Subscription tracking

• Simple dashboard

Ideal for:

• Overspenders

• Expense control

4. Goodbudget – Best for Envelope Budgeting

Goodbudget uses the envelope budgeting system.

It works well for couples and families managing shared finances.

Best features:

• Envelope-based budgeting

• Manual expense tracking

• Shared budgets

Ideal for:

• Families

• Couples

How Budgeting Apps Help You Save More

Budgeting apps encourage better financial habits.

They help users:

• Identify unnecessary spending

• Stick to budgets

• Track savings progress

• Avoid financial surprises

Common Mistakes When Using Budgeting Apps

Budgeting apps only work when used correctly.

Avoid these mistakes:

• Ignoring daily updates

• Setting unrealistic budgets

• Not reviewing monthly reports

• Relying only on automation

Final Thoughts

The best budgeting app is the one you use consistently.

Whether you prefer automation or manual control, budgeting apps make managing money simpler and more effective.

With the right app and discipline, saving money becomes easier and more achievable.

Instead of tracking expenses manually, these apps help users manage income, control spending, and build savings efficiently.

This article compares the best budgeting apps and explains how they can help you save more money.

Why Use a Budgeting App?

Many people struggle with saving because they don’t track where their money goes.

Budgeting apps provide a clear overview of spending habits and financial health.

Benefits of budgeting apps include:

• Easy expense tracking

• Better money awareness

• Improved saving habits

• Reduced financial stress

Key Features to Look for in a Budgeting App

Not all budgeting apps are the same.

Choosing the right one depends on your financial goals and lifestyle.

Important features include:

• Expense categorization

• Budget alerts

• Savings tracking

• Bank synchronization

• User-friendly interface

1. Mint – Best for Beginners

Mint is one of the most popular free budgeting apps.

It automatically tracks expenses and categorizes transactions.

Best features:

• Automatic expense tracking

• Budget alerts

• Credit score monitoring

Ideal for:

• Beginners

• Simple budgeting needs

2. YNAB (You Need A Budget) – Best for Serious Budgeting

YNAB focuses on proactive budgeting.

It encourages users to assign every dollar a job.

Best features:

• Goal-based budgeting

• Debt management tools

• Educational resources

Ideal for:

• People focused on saving

• Debt reduction goals

3. PocketGuard – Best for Expense Control

PocketGuard shows how much money you can safely spend.

It prevents overspending by calculating disposable income.

Best features:

• Spending limits

• Subscription tracking

• Simple dashboard

Ideal for:

• Overspenders

• Expense control

4. Goodbudget – Best for Envelope Budgeting

Goodbudget uses the envelope budgeting system.

It works well for couples and families managing shared finances.

Best features:

• Envelope-based budgeting

• Manual expense tracking

• Shared budgets

Ideal for:

• Families

• Couples

How Budgeting Apps Help You Save More

Budgeting apps encourage better financial habits.

They help users:

• Identify unnecessary spending

• Stick to budgets

• Track savings progress

• Avoid financial surprises

Common Mistakes When Using Budgeting Apps

Budgeting apps only work when used correctly.

Avoid these mistakes:

• Ignoring daily updates

• Setting unrealistic budgets

• Not reviewing monthly reports

• Relying only on automation

Final Thoughts

The best budgeting app is the one you use consistently.

Whether you prefer automation or manual control, budgeting apps make managing money simpler and more effective.

With the right app and discipline, saving money becomes easier and more achievable.

2,134 views

Advertisement

Ad Space